In today's world, the importance of environmental sustainability cannot be overstated. As our planet grapples with the consequences of climate change and other environmental challenges, it has become imperative for individuals, businesses, and governments to take action and make a positive impact. One avenue that has gained significant attention in recent years is green finance, a concept that focuses on investing in projects and initiatives that promote environmental sustainability.

"Understanding the Concept of Green Finance"

The evolution of green finance has given rise to a range of innovative investment strategies and financial products that enable individuals and organizations to contribute to a more sustainable future. At its core, green finance seeks to allocate capital to projects that have a positive impact on the environment while also generating financial returns. This dual focus makes it an attractive proposition for investors looking to align their financial goals with their values.

"The Evolution of Green Finance"

Over the years, the concept of green finance has evolved from a niche area of investment to a mainstream practice. Initially, it was primarily driven by ethical and socially responsible investors who wanted to align their portfolios with their environmental beliefs. However, as the environmental and social impacts of climate change became more evident, governments and financial institutions started to recognize the need for a more systematic approach.

As the demand for green finance grew, financial institutions began to develop specialized products and services to cater to this emerging market. Green bonds, for example, became a popular investment vehicle, allowing investors to support environmentally friendly projects while earning a fixed income. These bonds are typically issued by governments, municipalities, or corporations, and the proceeds are used to fund projects such as renewable energy infrastructure, energy-efficient buildings, and sustainable transportation.

"Key Principles of Green Finance"

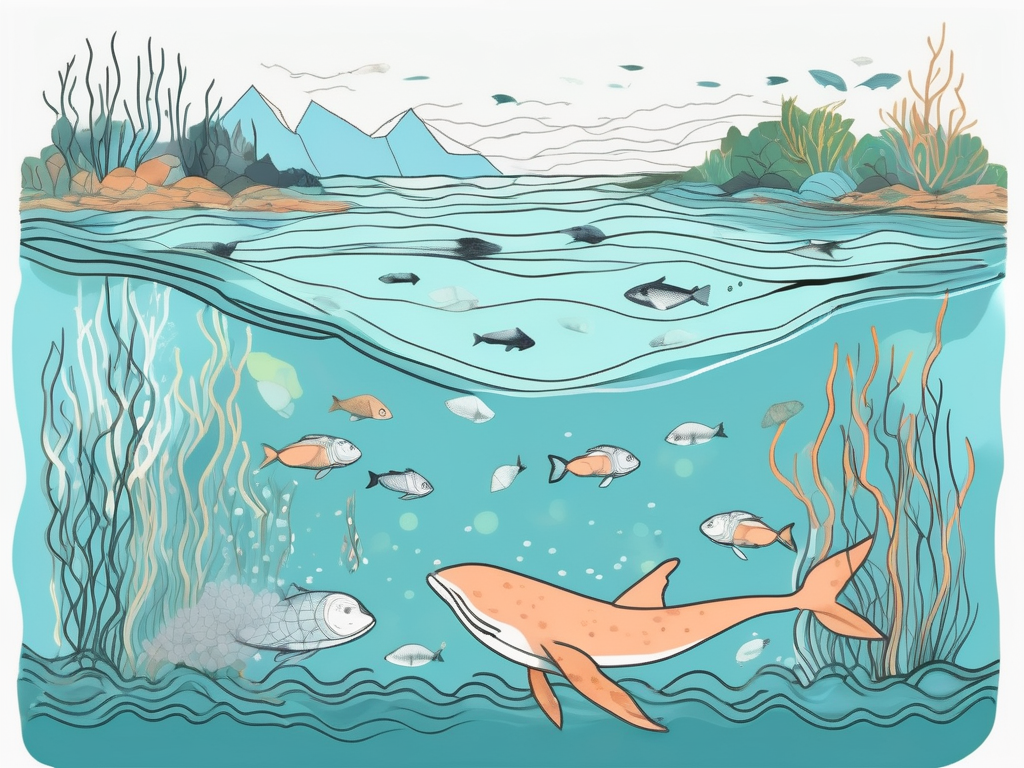

Several key principles underpin green finance. First and foremost is the idea of sustainability. Investments made under the umbrella of green finance should focus on projects that contribute to the long-term well-being of the planet. This includes initiatives aimed at reducing carbon emissions, conserving natural resources, and promoting biodiversity. By investing in these projects, individuals and organizations can play a crucial role in mitigating the effects of climate change and preserving the Earth for future generations.

Transparency and accountability are also crucial aspects of green finance. Investors should have access to relevant and accurate information about the environmental impact and financial performance of their investments. This allows them to make informed decisions and hold companies accountable for their sustainability practices. In recent years, there has been a growing demand for standardized reporting frameworks, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), which provide guidelines for companies to disclose their environmental, social, and governance (ESG) performance.

Furthermore, innovation and collaboration play a significant role in driving the growth of the green finance sector. Financial institutions, governments, and non-profit organizations are increasingly working together to develop new financing models and promote sustainable investment practices. For example, impact investing has gained traction as a way to generate both financial returns and positive social or environmental outcomes. This approach involves investing in companies or projects that address pressing social or environmental issues, such as access to clean water or affordable renewable energy.

In conclusion, green finance has evolved from a niche concept to a mainstream practice, driven by the growing recognition of the need for sustainable investment solutions. By adhering to key principles such as sustainability, transparency, and collaboration, green finance offers individuals and organizations the opportunity to make a positive impact on the environment while also achieving their financial goals.

"The Role of Green Finance in Environmental Sustainability"

Green finance plays a pivotal role in promoting environmental sustainability in several ways. First and foremost, it helps to mobilize capital for projects that support sustainable development. Whether it is renewable energy infrastructure, energy-efficient buildings, or sustainable agriculture, green finance provides the financial resources needed to implement these initiatives on a large scale.

"Promoting Sustainable Development"

One of the key objectives of green finance is to promote sustainable development. By directing capital towards environmentally friendly projects, it enables economic growth that is in harmony with the natural environment. This holistic approach ensures that development is not achieved at the expense of future generations but rather seeks to create a more equitable and sustainable future for all.

"Addressing Climate Change"

Green finance also plays a crucial role in addressing climate change, one of the greatest challenges of our time. By investing in low-carbon technologies and renewable energy sources, it helps to reduce greenhouse gas emissions and mitigate the impact of climate change. Moreover, it encourages the adoption of sustainable practices and fosters the development of innovative solutions to combat the effects of global warming.

"The Global Landscape of Green Finance"

While green finance has gained traction around the world, there are notable differences in its adoption and implementation across countries and regions.

"Green Finance in Developed Countries"

Developed countries, with their robust financial systems and established regulatory frameworks, have been at the forefront of green finance. These countries have seen significant investments in renewable energy projects, sustainable infrastructure, and green bonds. Additionally, financial institutions in these countries have developed sophisticated tools and methodologies to assess the environmental impact and financial viability of green investments.

"Green Finance in Developing Countries"

Developing countries, on the other hand, face unique challenges in adopting green finance. Limited access to capital, weak regulatory frameworks, and inadequate infrastructure often hinder the growth of the green finance sector in these countries. However, there are encouraging signs of progress as governments, international organizations, and development banks work together to address these challenges and promote sustainable investment practices in emerging economies.

"Challenges and Opportunities in Green Finance"

While green finance holds tremendous promise, it also faces several challenges that need to be overcome for its widespread adoption.

"Overcoming Obstacles in Green Finance"

One of the major obstacles is the lack of standardized definitions and metrics for measuring the environmental impact of investments. This hinders transparency and comparability, making it difficult for investors to make informed decisions. Moreover, there is a need for better risk assessment and management tools to address the unique risks associated with green investments.

"Potential Growth and Opportunities"

Despite these challenges, green finance presents significant growth opportunities. The transition to a low-carbon economy requires substantial investments in renewable energy, sustainable infrastructure, and climate resilience. This opens up avenues for innovative financial products and services that cater to the specific needs of the green finance sector. Additionally, green finance has the potential to create new jobs and stimulate economic growth in sectors that are aligned with environmental sustainability.

"Future of Green Finance"

As we look ahead, the future of green finance is poised for further expansion and evolution.

"Emerging Trends in Green Finance"

One of the emerging trends is the integration of environmental, social, and governance (ESG) factors into investment decision-making. Investors are increasingly recognizing the importance of considering non-financial aspects when evaluating investment opportunities. This holistic approach enables them to assess the sustainability and long-term viability of investments.

"The Impact of Technological Advancements on Green Finance"

Technological advancements, such as blockchain and artificial intelligence, are also expected to have a profound impact on green finance. These technologies can enhance transparency, facilitate efficient and secure transactions, and enable the tracking of environmental data. By leveraging these advancements, green finance can become more accessible, scalable, and resilient.

In conclusion, green finance represents a powerful tool that can drive positive change and contribute to environmental sustainability. By investing in projects and initiatives that promote a greener future, individuals, businesses, and governments can play their part in mitigating the challenges posed by climate change and fostering a more sustainable world for generations to come.