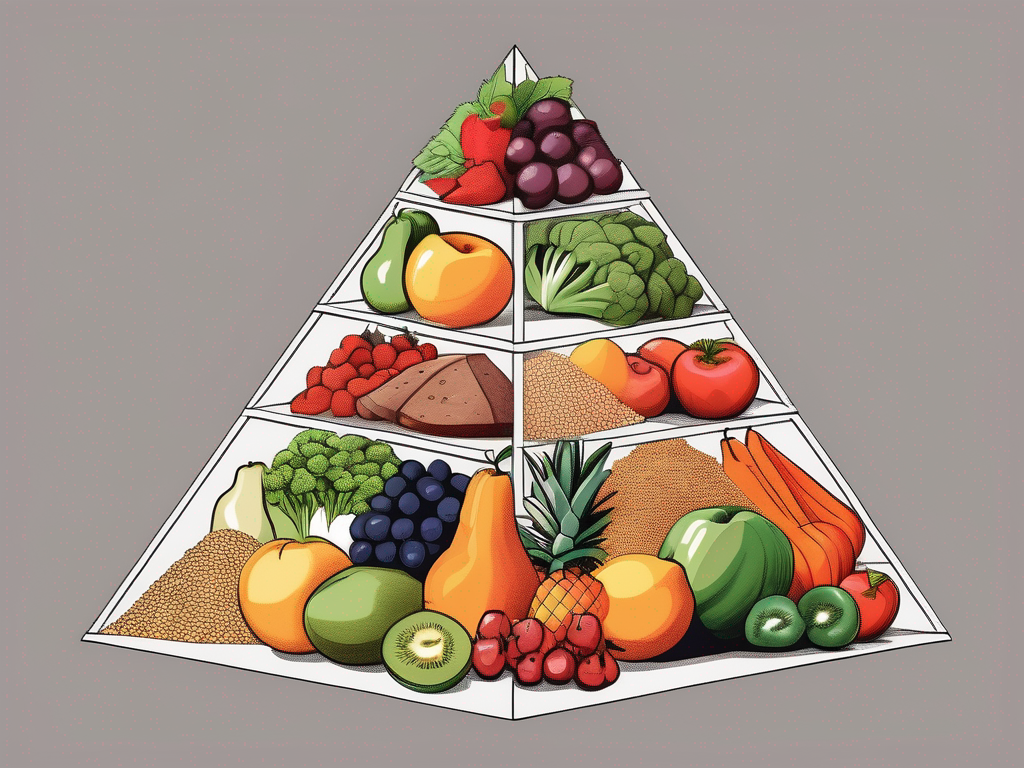

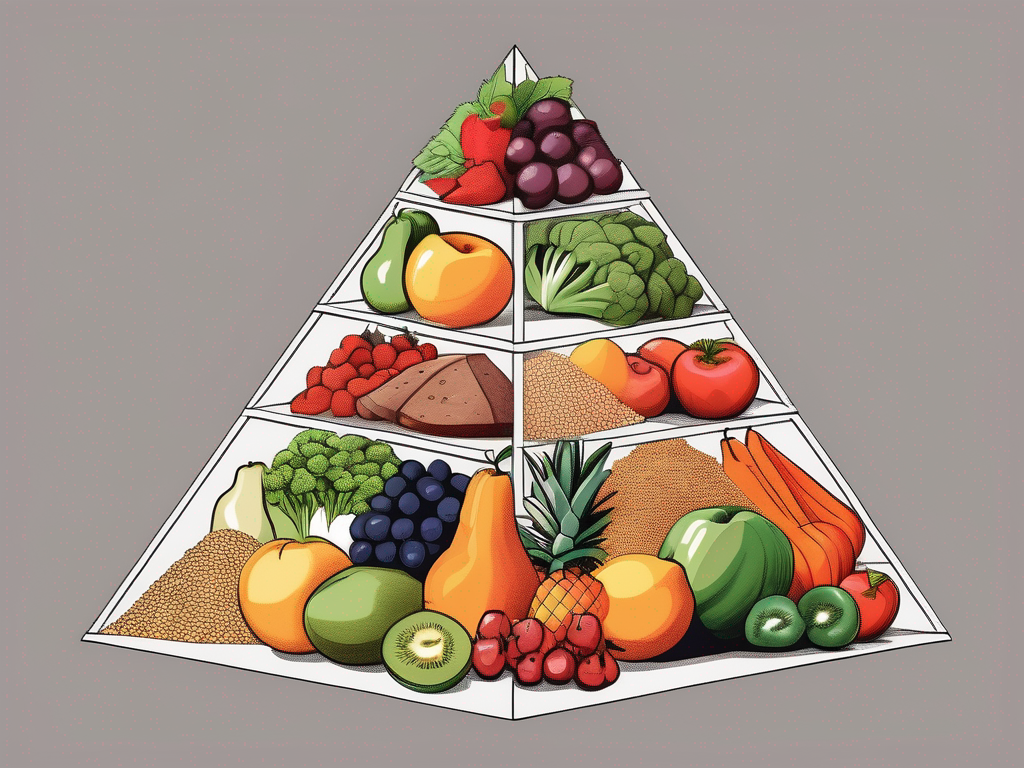

The Ultimate Guide to Nutrition

Discover the comprehensive and insightful Ultimate Guide to Nutrition, packed with expert advice, practical tips, and evidence-based information to help you make informed choices about your diet and overall health.

Discover how personal branding can transform your career in the digital age.

Discover how to cultivate a resilient mindset and thrive amidst life's inevitable changes.

Looking to make a smooth transition to a new industry? Our article "Navigating Career Transitions: Tips for Seamless Industry Switches" offers valuable insights and practical tips to help you successfully navigate a career change.

Discover the ultimate guide to fitness with expert tips and tricks for a healthier lifestyle.

Discover the comprehensive and insightful Ultimate Guide to Nutrition, packed with expert advice, practical tips, and evidence-based information to help you make informed choices about your diet and overall health.

Discover how to cultivate a resilient mindset and thrive amidst life's inevitable changes.

Explore the innovative accessibility technologies that are breaking down barriers for people with disabilities.

Discover the surprising connection between smartphones and adult health in this insightful article.

Discover how artificial intelligence is revolutionizing personal finance and reshaping the way we manage our money.

Discover how virtual reality is revolutionizing training and education in this in-depth article.

Discover how personal branding can transform your career in the digital age.

Looking to make a smooth transition to a new industry? Our article "Navigating Career Transitions: Tips for Seamless Industry Switches" offers valuable insights and practical tips to help you successfully navigate a career change.